Building a Solid Budget: The Foundation of Financial Wellness

Before you can even think about investing or saving aggressively, you need a budget. This isn’t about deprivation; it’s about understanding where your money goes. Track your spending for a month – every coffee, every grocery trip, every subscription. Use budgeting apps, spreadsheets, or even a notebook. Once you see your spending habits laid out, you can identify areas where you can cut back and allocate funds towards your financial goals. Remember, budgeting isn’t a one-time event; it’s an ongoing process requiring regular review and adjustment.

Emergency Fund: Your Financial Safety Net

Life throws curveballs. Job loss, medical emergencies, unexpected car repairs – these events can derail your financial progress if you’re not prepared. An emergency fund acts as a safety net, preventing you from going into debt during unforeseen circumstances. Aim for 3-6 months’ worth of living expenses saved in a readily accessible account, like a high-yield savings account. This fund is your first line of defense against financial hardship, allowing you to navigate challenges without jeopardizing your long-term financial well-being.

Smart Saving Strategies: Growing Your Wealth

Saving isn’t just about stuffing money under your mattress. Explore different savings vehicles to maximize your returns. High-yield savings accounts offer better interest rates than traditional accounts. Consider certificates of deposit (CDs) for longer-term savings with fixed interest rates. Automate your savings by setting up recurring transfers from your checking account to your savings account. Even small, consistent contributions add up over time, thanks to the power of compounding interest.

Investing for the Future: Building Long-Term Wealth

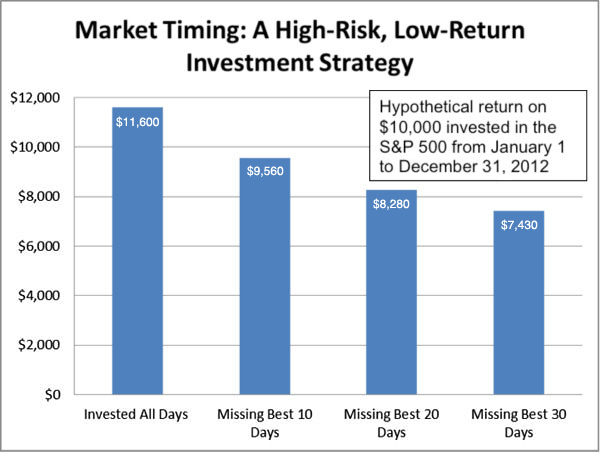

Saving is crucial, but investing allows your money to grow at a faster rate. Investing can feel daunting, but it’s essential for building long-term wealth. Start by learning about different investment options, such as stocks, bonds, mutual funds, and ETFs. Consider your risk tolerance and time horizon before making any investment decisions. Diversifying your portfolio across different asset classes helps mitigate risk. If you’re unsure where to start, consider consulting a financial advisor to create a personalized investment plan.

Understanding Debt Management: Tackling Your Liabilities

Debt can significantly hinder your financial progress. High-interest debt, like credit card debt, should be prioritized. Develop a debt repayment strategy, such as the snowball or avalanche method, to systematically pay down your debts. Explore options like balance transfers to lower interest rates. Avoid accumulating new debt whenever possible, focusing on responsible spending habits. Remember, getting out of debt is a marathon, not a sprint, so be patient and persistent.

The Power of Financial Literacy: Continuous Learning

Financial wellness isn’t a destination; it’s a journey of continuous learning. Stay informed about personal finance topics through books, articles, podcasts, and workshops. Understand the importance of credit scores, learn about different insurance options, and stay updated on economic trends. The more you know, the better equipped you’ll be to make informed financial decisions and achieve your long-term financial goals. Remember that seeking professional advice from a financial advisor can be invaluable in navigating complex financial situations.

Protecting Your Assets: Insurance and Planning

Protecting your hard-earned assets is a vital component of financial wellness. Adequate insurance coverage, including health, auto, home, and life insurance, safeguards you against unexpected financial burdens. Furthermore, estate planning, including creating a will and considering trusts, ensures your assets are distributed according to your wishes. These proactive measures provide peace of mind and protect your loved ones in the event of unforeseen circumstances.

Retirement Planning: Securing Your Golden Years

Retirement may seem distant, but planning for it early is crucial. Start contributing to retirement accounts like 401(k)s and IRAs as soon as possible, taking advantage of employer matching contributions if offered. Understand different retirement account options and choose the ones that best suit your needs and financial situation. Regularly review your retirement savings and adjust your contributions as needed to stay on track with your retirement goals. Remember, consistent contributions and strategic investment choices are key to a comfortable retirement. Click here about money management advisor