Enduring Returns: Long-Term Benefits of Wise Investments

Enduring Returns: Long-Term Benefits of Wise Investments

Investing with a long-term perspective can yield substantial benefits, providing financial stability, growth, and security. This article explores the various advantages of making wise, long-term investments that extend beyond immediate gains.

Building Wealth Through Strategic Investments

Long-term benefit investments form the cornerstone of wealth-building strategies. By choosing investments with growth potential and resisting the temptation of quick returns, individuals lay the foundation for enduring financial prosperity. Strategic planning and patience are key elements in accumulating wealth over time.

Compound Interest: The Eighth Wonder

Compound interest is a powerful force in long-term investing. As earnings generate additional earnings over time, the compounding effect accelerates wealth growth. By reinvesting returns, investors can witness exponential growth, emphasizing the importance of starting early and allowing investments to compound over the long haul.

Stability and Risk Mitigation

Long-term investments often involve a diversified portfolio, which contributes to stability and risk mitigation. Diversification spreads investments across various assets, reducing the impact of market volatility on the overall portfolio. This approach provides a buffer against short-term market fluctuations and contributes to a more stable investment journey.

Retirement Planning and Financial Security

Wise long-term investments play a pivotal role in retirement planning. Building a robust investment portfolio over the years ensures a steady income stream during retirement. This financial security allows individuals to enjoy their post-career years without the stress of financial instability, emphasizing the importance of foresight in investment decisions.

Realizing Financial Goals and Dreams

Long-term investments align with achieving financial goals and realizing dreams. Whether it’s buying a home, funding education, or starting a business, wise investments contribute to the realization of long-held aspirations. The discipline of long-term planning turns financial dreams into achievable milestones.

Tax Efficiency and Long-Term Capital Gains

Certain long-term investments benefit from tax efficiency, particularly in the case of long-term capital gains. Holding investments for an extended period can result in favorable tax treatment, reducing the overall tax burden on investment returns. This tax efficiency enhances the net returns and adds to the attractiveness of long-term investing.

Weathering Economic Downturns

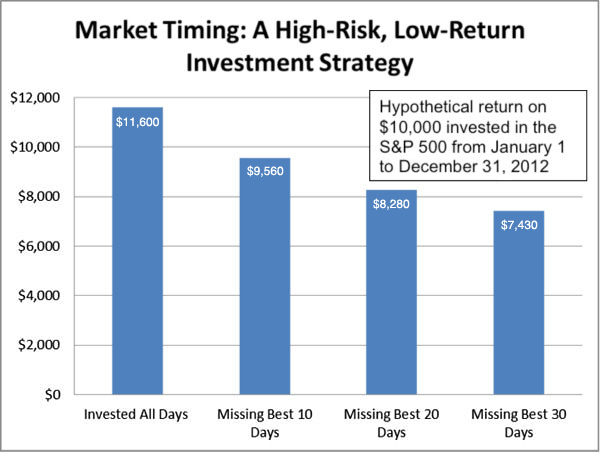

Long-term investors are better equipped to weather economic downturns. Instead of reacting impulsively to short-term market fluctuations, they can ride out economic storms with confidence, knowing that their investments have time to recover. This resilience is a key advantage in navigating the unpredictable nature of financial markets.

Environmental, Social, and Governance (ESG) Investing

The rise of ESG investing aligns with long-term benefit strategies. Investors increasingly consider environmental, social, and governance factors in their decision-making process. By investing in companies with sustainable practices and ethical governance, individuals contribute to a more responsible and enduring financial ecosystem.

Legacy and Generational Wealth

Long-term investments have the potential to create a lasting legacy and generational wealth. Strategic planning and disciplined investing can provide a financial foundation that extends beyond an individual’s lifetime, benefiting future generations. This focus on legacy-building adds a profound dimension to long-term investment strategies.

Continuous Learning and Adaptation

Successful long-term investors embrace a mindset of continuous learning and adaptation. Staying informed about market trends, economic shifts, and emerging opportunities allows investors to adjust their strategies over time. This commitment to learning and adapting is essential for maximizing the benefits of long-term investments.

Long-Term Benefit Investment: A Link to Financial Prosperity

Ready to explore the enduring returns of wise investments? Discover the strategies and insights at Long-Term Benefit Investment. Learn how a thoughtful and patient approach to investing can pave the way for enduring financial prosperity and security.

In conclusion, the long-term benefits of wise investments extend far beyond monetary gains. From building wealth and financial security to realizing dreams and creating a lasting legacy, long-term investment strategies contribute to a fulfilling and prosperous financial journey. By understanding the enduring returns of patient and strategic investing, individuals can make informed decisions that lead to a brighter financial future.

Green Investment Benefit: Sowing Seeds of Sustainability

Sowing Seeds of Sustainability: The Green Investment Benefit

In a world increasingly focused on environmental stewardship, the concept of the Green Investment Benefit is gaining prominence. This article explores the multifaceted advantages of green investing, shedding light on how financial choices can not only yield profitable returns but also contribute to a more sustainable and eco-friendly future.

Defining Green Investment

Green investment refers to allocating financial resources to projects, businesses, or initiatives that prioritize environmental sustainability. These ventures often involve renewable energy, energy efficiency, clean technology, and other eco-friendly practices. Green investors seek both financial returns and positive environmental impact in their investment portfolios.

Profitability and Environmental Impact

One of the primary benefits of green investment is the potential for profitability alongside positive environmental impact. Historically, green investments have demonstrated competitive returns, dispelling the myth that sustainability comes at the cost of financial gains. As the global focus on environmental issues intensifies, sustainable businesses are positioned for long-term success.

Renewable Energy Ventures

A significant portion of green investment is directed towards renewable energy ventures. Solar, wind, hydro, and other clean energy sources offer not only a sustainable solution to energy needs but also lucrative investment opportunities. Investing in renewable energy contributes to reducing reliance on fossil fuels and mitigating climate change.

Energy Efficiency Projects

Green investment extends to energy efficiency projects that aim to optimize energy consumption. From smart buildings to industrial processes, funding initiatives that prioritize energy efficiency not only reduce environmental impact but also lower operational costs for businesses, creating a win-win scenario for investors.

Clean Technology and Innovation

Investing in clean technology and innovation is a hallmark of green investment. Startups and companies developing sustainable solutions, such as electric vehicles, advanced recycling technologies, and eco-friendly materials, attract capital from investors seeking to support and benefit from the latest environmental innovations.

Environmental, Social, and Governance (ESG) Criteria

Green investors often use Environmental, Social, and Governance (ESG) criteria to evaluate the sustainability and ethical practices of potential investments. By considering a company’s commitment to environmental protection, social responsibility, and strong governance, investors align their portfolios with values that prioritize long-term sustainability.

Diversification and Risk Mitigation

Including green investments in a diversified portfolio can contribute to risk mitigation. Traditional industries may face increased regulatory scrutiny and market volatility due to environmental concerns. Green investments, on the other hand, may offer stability and resilience in the face of evolving market dynamics.

Promoting Corporate Responsibility

Green investment is a powerful tool for promoting corporate responsibility. By directing capital towards environmentally conscious businesses, investors influence corporate practices and contribute to the transition towards a more sustainable and responsible global economy. This impact extends beyond financial gains to shaping a socially and environmentally responsible business landscape.

Positive Impact on Communities

Green investments often have a positive impact on local communities. Renewable energy projects, for example, create jobs, stimulate economic growth, and improve energy access in underserved areas. The Green Investment Benefit, therefore, extends beyond financial returns to fostering social and economic well-being.

Accessibility of Green Investment Opportunities

As awareness of environmental issues grows, the accessibility of green investment opportunities is expanding. From sustainable mutual funds to green bonds and impact investing platforms, individuals and institutions have a diverse array of options to align their investments with their values and contribute to a more sustainable future.

Explore the Green Investment Benefit Today

Ready to sow seeds of sustainability in your investment portfolio? Explore the possibilities and learn more about the Green Investment Benefit by visiting Green Investment Benefit. Make informed choices that not only yield financial returns but also contribute to a greener and more sustainable world.

In conclusion, the Green Investment Benefit represents a paradigm shift in the financial landscape. It showcases the potential for aligning financial success with environmental responsibility. By considering the environmental impact of investments, individuals and institutions have the power to contribute significantly to a more sustainable and eco-friendly future.