Financial Benefit Returns: Maximizing Investments for Success

Unlocking Success: The Strategic Approach to Financial Benefit Returns

In the world of investments and financial planning, achieving optimal returns is a paramount goal. The concept of financial benefit returns involves adopting a strategic approach to maximize investments, generate profits, and secure long-term financial success. Let’s delve into the key principles and strategies that contribute to unlocking financial benefit returns.

Understanding Financial Benefit Returns: A Comprehensive Perspective

Financial benefit returns encompass a broad spectrum of strategies aimed at generating positive outcomes from financial investments. It goes beyond the traditional view of returns solely in monetary terms; it includes factors such as risk management, portfolio diversification, and aligning investments with specific financial goals. This comprehensive perspective ensures a well-rounded approach to wealth accumulation.

Strategic Investment Planning: The Foundation for Success

At the core of financial benefit returns is strategic investment planning. This involves a careful analysis of financial goals, risk tolerance, and time horizon. By aligning investments with these factors, individuals can create a diversified portfolio that balances potential returns with acceptable levels of risk. Strategic planning lays the foundation for achieving both short-term gains and long-term financial success.

Diversification Strategies: Mitigating Risks for Enhanced Returns

Diversification is a key principle in maximizing financial benefit returns. By spreading investments across different asset classes, industries, and geographical regions, investors can mitigate risks associated with market volatility. Diversification not only safeguards against potential losses but also opens avenues for capturing opportunities in various sectors, ultimately enhancing overall returns.

Risk Management: Balancing Return and Volatility

Effective risk management is integral to the pursuit of financial benefit returns. Investors need to assess their risk tolerance and implement strategies to balance the desire for higher returns with the potential for increased volatility. This may involve a combination of conservative and growth-oriented investments to create a well-balanced and resilient portfolio.

Long-Term Vision: Patience as a Virtue in Wealth Building

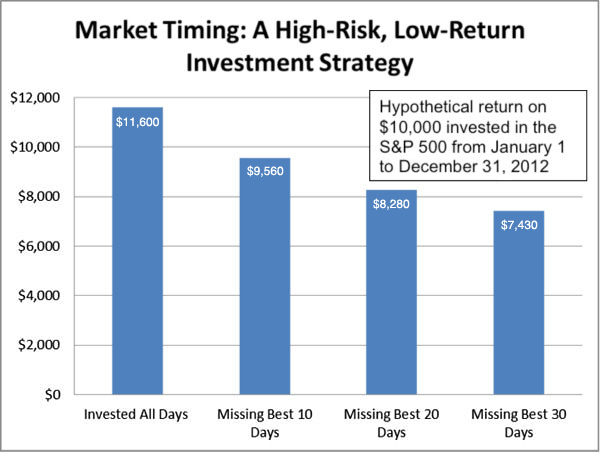

Financial benefit returns often materialize over the long term. Patience is a virtue when it comes to wealth building. Investors who maintain a long-term vision and resist the urge to react impulsively to short-term market fluctuations are more likely to experience the compounding effects of investments, resulting in sustained and substantial returns.

Continuous Monitoring and Adjustment: Adapting to Market Dynamics

The financial landscape is dynamic, and successful investors recognize the importance of continuous monitoring and adjustment. Regularly reviewing the portfolio, staying informed about market trends, and making strategic adjustments in response to economic shifts contribute to optimizing financial benefit returns. Flexibility and adaptability are key in navigating ever-changing market dynamics.

Educational Empowerment: Informed Decision-Making for Returns

Knowledge is a powerful tool in the quest for financial benefit returns. Investors who prioritize financial education make informed decisions about their investments. Understanding the fundamentals of various asset classes, staying informed about economic indicators, and seeking professional advice contribute to building a strong foundation for successful wealth management.

Leveraging Technology: Tools for Enhanced Financial Decision-Making

In the digital age, technology plays a pivotal role in optimizing financial benefit returns. Utilizing online platforms, investment apps, and data analytics tools empowers investors to make data-driven decisions. Technology provides real-time information, portfolio analysis, and access to a wide range of investment opportunities, enhancing the efficiency of financial planning and decision-making.

Evaluating Tax Efficiency: Maximizing After-Tax Returns

Financial benefit returns extend beyond the gross returns on investments. Evaluating tax efficiency is crucial for maximizing after-tax returns. Utilizing tax-advantaged accounts, implementing tax-loss harvesting strategies, and understanding the tax implications of different investment decisions contribute to enhancing the overall financial benefit returns.

Building a Holistic Financial Plan: Integration for Success

Ultimately, achieving optimal financial benefit returns requires the integration of various strategies into a holistic financial plan. This plan should encompass short-term and long-term goals, risk management, diversification, and ongoing monitoring. By adopting a comprehensive approach, individuals can position themselves for financial success and ensure that their investments align with their broader life objectives.

Explore the Path to Financial Benefit Returns Today

Ready to embark on the path to financial benefit returns? Visit Financial Benefit Returns for insightful resources, expert guidance, and tools to optimize your financial strategy. Whether you’re a seasoned investor or just starting, the available information will empower you to make informed decisions and maximize your financial benefit returns for a successful future.

Enduring Returns: Long-Term Benefits of Wise Investments

Enduring Returns: Long-Term Benefits of Wise Investments

Investing with a long-term perspective can yield substantial benefits, providing financial stability, growth, and security. This article explores the various advantages of making wise, long-term investments that extend beyond immediate gains.

Building Wealth Through Strategic Investments

Long-term benefit investments form the cornerstone of wealth-building strategies. By choosing investments with growth potential and resisting the temptation of quick returns, individuals lay the foundation for enduring financial prosperity. Strategic planning and patience are key elements in accumulating wealth over time.

Compound Interest: The Eighth Wonder

Compound interest is a powerful force in long-term investing. As earnings generate additional earnings over time, the compounding effect accelerates wealth growth. By reinvesting returns, investors can witness exponential growth, emphasizing the importance of starting early and allowing investments to compound over the long haul.

Stability and Risk Mitigation

Long-term investments often involve a diversified portfolio, which contributes to stability and risk mitigation. Diversification spreads investments across various assets, reducing the impact of market volatility on the overall portfolio. This approach provides a buffer against short-term market fluctuations and contributes to a more stable investment journey.

Retirement Planning and Financial Security

Wise long-term investments play a pivotal role in retirement planning. Building a robust investment portfolio over the years ensures a steady income stream during retirement. This financial security allows individuals to enjoy their post-career years without the stress of financial instability, emphasizing the importance of foresight in investment decisions.

Realizing Financial Goals and Dreams

Long-term investments align with achieving financial goals and realizing dreams. Whether it’s buying a home, funding education, or starting a business, wise investments contribute to the realization of long-held aspirations. The discipline of long-term planning turns financial dreams into achievable milestones.

Tax Efficiency and Long-Term Capital Gains

Certain long-term investments benefit from tax efficiency, particularly in the case of long-term capital gains. Holding investments for an extended period can result in favorable tax treatment, reducing the overall tax burden on investment returns. This tax efficiency enhances the net returns and adds to the attractiveness of long-term investing.

Weathering Economic Downturns

Long-term investors are better equipped to weather economic downturns. Instead of reacting impulsively to short-term market fluctuations, they can ride out economic storms with confidence, knowing that their investments have time to recover. This resilience is a key advantage in navigating the unpredictable nature of financial markets.

Environmental, Social, and Governance (ESG) Investing

The rise of ESG investing aligns with long-term benefit strategies. Investors increasingly consider environmental, social, and governance factors in their decision-making process. By investing in companies with sustainable practices and ethical governance, individuals contribute to a more responsible and enduring financial ecosystem.

Legacy and Generational Wealth

Long-term investments have the potential to create a lasting legacy and generational wealth. Strategic planning and disciplined investing can provide a financial foundation that extends beyond an individual’s lifetime, benefiting future generations. This focus on legacy-building adds a profound dimension to long-term investment strategies.

Continuous Learning and Adaptation

Successful long-term investors embrace a mindset of continuous learning and adaptation. Staying informed about market trends, economic shifts, and emerging opportunities allows investors to adjust their strategies over time. This commitment to learning and adapting is essential for maximizing the benefits of long-term investments.

Long-Term Benefit Investment: A Link to Financial Prosperity

Ready to explore the enduring returns of wise investments? Discover the strategies and insights at Long-Term Benefit Investment. Learn how a thoughtful and patient approach to investing can pave the way for enduring financial prosperity and security.

In conclusion, the long-term benefits of wise investments extend far beyond monetary gains. From building wealth and financial security to realizing dreams and creating a lasting legacy, long-term investment strategies contribute to a fulfilling and prosperous financial journey. By understanding the enduring returns of patient and strategic investing, individuals can make informed decisions that lead to a brighter financial future.