Economic Prosperity Benefit: Strategies for Financial Success

Economic Prosperity Benefit: Strategies for Financial Success

In an era where financial well-being is a top priority, understanding the economic prosperity benefit becomes crucial. This article delves into effective strategies for achieving financial success, highlighting the importance of informed decisions and smart investments.

Financial Education and Awareness

The foundation of economic prosperity lies in financial education and awareness. Understanding the basics of budgeting, saving, and investing empowers individuals to make informed decisions. Financial literacy enables better money management, fostering a path toward economic prosperity.

Strategic Budgeting and Expense Management

Creating and sticking to a strategic budget is a key component of financial success. By outlining income, expenses, and savings goals, individuals gain control over their finances. Effective expense management ensures that resources are allocated efficiently, supporting both short-term needs and long-term financial objectives.

Economic Prosperity Benefit: For comprehensive insights into achieving financial success, visit Economic Prosperity Benefit. The website offers expert advice, tips, and articles to guide you on the path to economic prosperity.

Smart Investing for Long-Term Growth

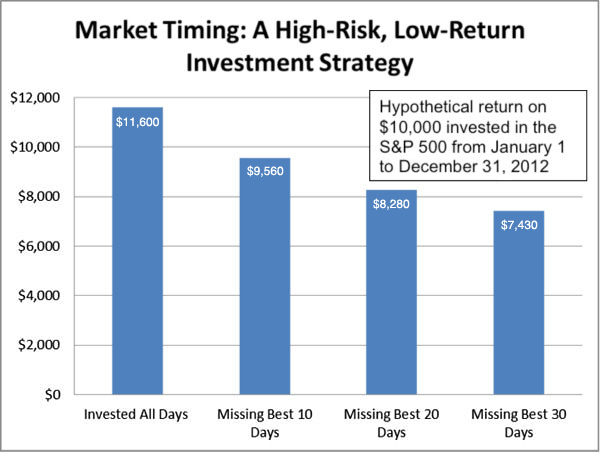

Investing wisely is a fundamental strategy for economic prosperity. Diversifying investments, understanding risk tolerance, and focusing on long-term growth are essential principles. Whether through stocks, real estate, or retirement accounts, strategic investing contributes to wealth accumulation over time.

Debt Management and Reduction

Effectively managing and reducing debt is critical for economic prosperity. High-interest debts can erode financial stability, making it crucial to prioritize debt repayment. Implementing debt reduction strategies, such as the snowball or avalanche method, contributes to overall financial health.

Emergency Fund for Financial Resilience

Building an emergency fund is a proactive step toward financial resilience. This fund serves as a safety net during unexpected expenses or emergencies, preventing the need for high-interest loans or credit card debt. Establishing and consistently adding to an emergency fund is a cornerstone of economic prosperity.

Career Development and Skill Enhancement

Investing in career development and skill enhancement is a strategic move for economic prosperity. Continuously improving skills and staying relevant in the job market enhances earning potential. Individuals who actively pursue opportunities for professional growth position themselves for financial success.

Entrepreneurship and Business Ventures

For those with an entrepreneurial spirit, starting a business or engaging in business ventures can be a pathway to economic prosperity. Successful entrepreneurship involves careful planning, market research, and a commitment to ongoing business development.

Homeownership and Real Estate Investments

Owning a home and exploring real estate investments contribute to economic prosperity. Real estate can provide a source of passive income through rental properties or offer long-term appreciation in property value. Homeownership is often considered a key aspect of wealth-building.

Financial Planning for Retirement

Planning for retirement is an integral part of achieving economic prosperity. Contributing to retirement accounts, such as 401(k)s or IRAs, and understanding the available investment options are essential steps. Strategic retirement planning ensures financial security in later years.

Continuous Financial Evaluation and Adjustment

Economic prosperity requires ongoing evaluation and adjustment of financial strategies. Regularly assessing financial goals, investment portfolios, and overall financial health allows individuals to adapt to changing circumstances and optimize their economic success.

Community Engagement and Financial Literacy Advocacy

Engaging with the community and advocating for financial literacy contribute to economic prosperity on a broader scale. Supporting initiatives that promote financial education and empower individuals in managing their finances fosters a culture of economic well-being.

Conclusion: Navigating the Path to Economic Prosperity

In conclusion, achieving economic prosperity involves a holistic approach to financial management. From education and strategic budgeting to investments and continuous evaluation, individuals can navigate the path to financial success. Explore Economic Prosperity Benefit for expert guidance, tips, and resources on maximizing your economic prosperity journey.

Enduring Returns: Long-Term Benefits of Wise Investments

Enduring Returns: Long-Term Benefits of Wise Investments

Investing with a long-term perspective can yield substantial benefits, providing financial stability, growth, and security. This article explores the various advantages of making wise, long-term investments that extend beyond immediate gains.

Building Wealth Through Strategic Investments

Long-term benefit investments form the cornerstone of wealth-building strategies. By choosing investments with growth potential and resisting the temptation of quick returns, individuals lay the foundation for enduring financial prosperity. Strategic planning and patience are key elements in accumulating wealth over time.

Compound Interest: The Eighth Wonder

Compound interest is a powerful force in long-term investing. As earnings generate additional earnings over time, the compounding effect accelerates wealth growth. By reinvesting returns, investors can witness exponential growth, emphasizing the importance of starting early and allowing investments to compound over the long haul.

Stability and Risk Mitigation

Long-term investments often involve a diversified portfolio, which contributes to stability and risk mitigation. Diversification spreads investments across various assets, reducing the impact of market volatility on the overall portfolio. This approach provides a buffer against short-term market fluctuations and contributes to a more stable investment journey.

Retirement Planning and Financial Security

Wise long-term investments play a pivotal role in retirement planning. Building a robust investment portfolio over the years ensures a steady income stream during retirement. This financial security allows individuals to enjoy their post-career years without the stress of financial instability, emphasizing the importance of foresight in investment decisions.

Realizing Financial Goals and Dreams

Long-term investments align with achieving financial goals and realizing dreams. Whether it’s buying a home, funding education, or starting a business, wise investments contribute to the realization of long-held aspirations. The discipline of long-term planning turns financial dreams into achievable milestones.

Tax Efficiency and Long-Term Capital Gains

Certain long-term investments benefit from tax efficiency, particularly in the case of long-term capital gains. Holding investments for an extended period can result in favorable tax treatment, reducing the overall tax burden on investment returns. This tax efficiency enhances the net returns and adds to the attractiveness of long-term investing.

Weathering Economic Downturns

Long-term investors are better equipped to weather economic downturns. Instead of reacting impulsively to short-term market fluctuations, they can ride out economic storms with confidence, knowing that their investments have time to recover. This resilience is a key advantage in navigating the unpredictable nature of financial markets.

Environmental, Social, and Governance (ESG) Investing

The rise of ESG investing aligns with long-term benefit strategies. Investors increasingly consider environmental, social, and governance factors in their decision-making process. By investing in companies with sustainable practices and ethical governance, individuals contribute to a more responsible and enduring financial ecosystem.

Legacy and Generational Wealth

Long-term investments have the potential to create a lasting legacy and generational wealth. Strategic planning and disciplined investing can provide a financial foundation that extends beyond an individual’s lifetime, benefiting future generations. This focus on legacy-building adds a profound dimension to long-term investment strategies.

Continuous Learning and Adaptation

Successful long-term investors embrace a mindset of continuous learning and adaptation. Staying informed about market trends, economic shifts, and emerging opportunities allows investors to adjust their strategies over time. This commitment to learning and adapting is essential for maximizing the benefits of long-term investments.

Long-Term Benefit Investment: A Link to Financial Prosperity

Ready to explore the enduring returns of wise investments? Discover the strategies and insights at Long-Term Benefit Investment. Learn how a thoughtful and patient approach to investing can pave the way for enduring financial prosperity and security.

In conclusion, the long-term benefits of wise investments extend far beyond monetary gains. From building wealth and financial security to realizing dreams and creating a lasting legacy, long-term investment strategies contribute to a fulfilling and prosperous financial journey. By understanding the enduring returns of patient and strategic investing, individuals can make informed decisions that lead to a brighter financial future.